Over the last decade we’ve seen inspiring examples of healthcare-community development investing, including the success stories represented by Invest Health grantees and place-based investments by members of the Healthcare Anchor Network (HAN). Large insurers like United Healthcare and Humana are shifting their investment strategies toward community development in housing (e.g. UHC’s Health and Housing Fund in partnership with Stewards for Affordable Housing for the Future and the National Affordable Housing Trust) and other wellbeing outcomes (e.g. Humana’s Health Outcomes Fund in partnership with Quantified Ventures and Volunteers of America).

Looking back on the last 10 years, community investors have seen the healthcare and community development sectors come closer together. Most sectors are now comfortable with terminology like Social Determinants of Health (SDOH) when they might not have known what that meant ten years ago, and healthcare institutions have mobilized more capital toward neighborhood revitalization efforts. There is an ever-growing universe of bright spots.

Even so, these cross-sector investment examples need to be institutionalized in practice, rather than occurring as bespoke and disparate events. In order to not lose momentum in this opportune time, our work at the intersection of the healthcare, impact investing, and community development must help build the ecosystem for SDOH impact investing so that we can see the field move from a series of one-offs toward a market that values health.

Though there are many more, this blog focuses on a few key building blocks for creating and sustaining a SDOH impact investing ecosystem. They include:

- Systematically apply the SDOH framework to community investing – from language to measurement.

- Engage health systems and insurers as SDOH impact investors, not just donors.

- Center SDOH investments on racial and health equity.

Systematically Applying the SDOH Framework

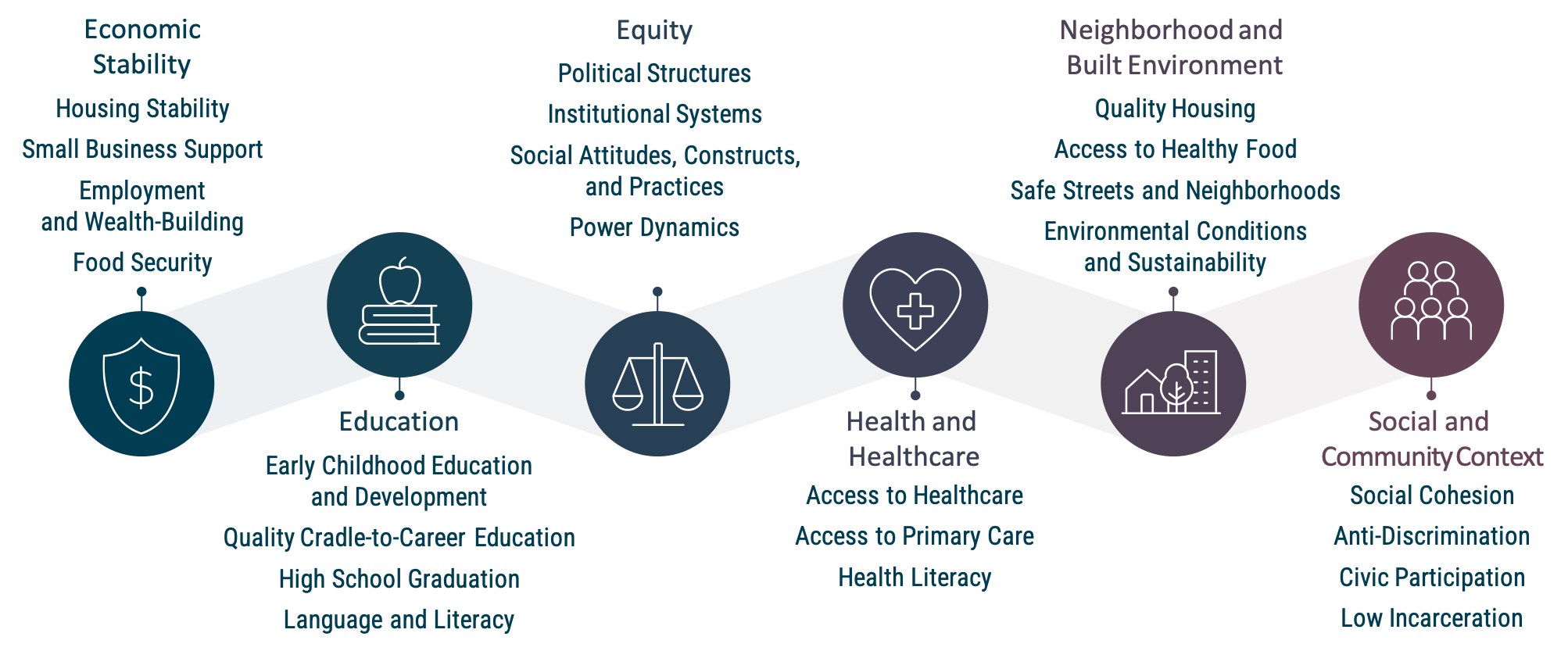

At Multiplier Advisors, we’ve found that the SDOH framework is a truly unifying one that brings investors with different SDOH priorities together around a common goal. We’ve adapted the Healthy People 2030 framework as the foundation to our own work, elevating Equity (both race and health equity) as its own SDOH domain.

SDOH-focused funds are great mechanisms for both attracting and deploying capital across SDOH to address range of barriers to health and well-being. For example, the Low Income Investment Fund and Purpose Built Communities just announced the launch of the Accelerator Fund, a $45 million fund that supports housing, education, and wellness in communities across the country. Intermountain Healthcare used SDOH as the investment, governance, and measurement framework for the $100 million Utah Housing Preservation Fund. These are both scalable and replicable examples.

They also help move the field toward a broader definition of “health”. At Multiplier Advisors, we find that we are still pushing against the older, narrower understanding of health which is more medically focused (e.g. health clinics), in service to healthy lifestyles (e.g. nutrition or exercise), or programmatically geared toward social needs (e.g. Community Health Workers, food pantries). While these aspects to health are important and worthwhile, the SDOH framework helps paint the bigger picture for investable opportunities that deliver both impact and financial returns while addressing root causes of poor health, poverty, and discrimination. For example, an Ohio pilot by a nonprofit Managed Care Organization invested in stably housing low income pregnant mothers, providing them with income and housing support in addition to clinical care which resulted into healthier babies and mothers with better economic outcomes.

This leads to SDOH as a measurement framework. The same MCO mentioned above measured health impact, cost savings, and financial returns to inform policy and to make the internal case for more additional SDOH investment. A closer look at the UN Sustainable Development Goals for impact investing reveals clear overlap with SDOH. The Healthy Neighborhoods Equity Fund uses an SDOH scorecard to make investment decisions and track impact for investors – a groundbreaking model that deserves a closer look. There’s more to be done to support both SDOH impact measurement and management as we build the ecosystem for SDOH impact investing.

Engage health systems and insurers as SDOH impact investors

To-date, healthcare systems and payers have been primarily engaged as tax credit investors or grantors. Yet ostensibly they have more to bring to the table. As SDOH impact investors, healthcare actors can engage their larger investment portfolios to advance SDOH. In fact, they could offer a range of capital across a capital stack (catalytic capital through grants, concessionary capital through loans, and potentially returns-seeking capital through venture or non-concessionary financing dollars). As an example, working with an SDOH impact intermediary like a Community Development Finance Institution (CDFI), a nonprofit healthcare system could structure a fund that includes grant funds from its foundation, below-market-rate financing as part of its community benefit requirement, and market-rate financing from its investment portfolio that might otherwise be invested in bond funds in the stock market. One can argue that health systems don’t yet engage in this way partly because there is not an SDOH impact investing ecosystem – an issue partly solved by applying the SDOH framework to identify SDOH investable opportunities. For example, with a SDOH frame, this venture fund could squarely fit in an SDOH impact investor’s portfolio. CDFIs and other SDOH investment intermediaries can appeal to healthcare investors’ SDOH preferences and return preferences to open new doors, and new portfolios, for partnership.

Centering on race and health equity

By definition, a market that values health must center racial and health equity. This means that all market actors – SDOH impact investors and intermediaries such as CDFIs – must be open to re-examining the role their institutions play in the communities they serve. Are they trusted by community members? Do residents lead the decision making on what investments are needed and where? Do any of their investments hinder progress under the SDOH framework? CDFIs in particular are taking a close look at their internal programs and practices with good results. Healthcare systems and insurers must continue to lean on local partners in their communities to forge partnerships and make investments that leverage local assets, and all investors can beware persistent power dynamics that have historically harmed marginalized communities and can perpetuate the root causes of poor health and poverty.

Investment partnerships across sectors have certainly become more commonplace, especially in small and mid-sized cities where specific ingredients for success may exist: smaller places may be able to define the SDOH challenges more concisely than their large urban counterparts, local partners may see the clear lines to partnership more quickly including connections to city agents and officials. At the same time, these communities also may confront unique barriers including lack of capital and capacity for SDOH investment and lack of an investment pipeline. As a field, we can do more to build the roadmap and market infrastructure for SDOH impact investing. In closing, let’s consider a set of market building next steps:

- Innovate on SDOH impact management and measurement tools to help build out market infrastructure;

- Engage nonprofit health systems in conversations beyond community benefits dollars and project-level deals, and engage insurers in investing beyond Low Income Housing Tax Credit deals, elevating the idea of “whole portfolio” investing including SDOH impact investments that can deliver both health and financial returns;

- Support CDFIs and local developers in the specific skills and capacity needed to absorb and deploy SDOH impact investments.

There is work to be done – Multiplier Advisors looks forward to seeing you out there!

About the Author

Colby Dailey, Principal of Multiplier Advisors™, is a social impact executive and entrepreneur with over a decade of experience connecting institutions across the healthcare and community development sectors, building partnerships that advance equity and address the social determinants of health (SDOH). Her experience includes consulting with and working for health systems, health insurers, CDFIs, philanthropy, local government, and affordable housing developers, as well as other impact investors and impact investing intermediaries. Colby helps institutions from across these industries identify and articulate shared aims and create strategies for investing together in SDOH with measurable social and financial returns. Before launching Multiplier Advisors, Colby co-founded and led the Build Healthy Places Network (BHPN), building the national center at the intersection of community development and health. Prior to BHPN, she created the Impact Investing Policy Collaborative, a network of researchers, investors and policymakers from over 30 countries that led to a global launch of policy principles. Colby also co-founded what is now Grounded Solutions Network, the national trade association for shared equity homeownership programs and community land trusts. Colby is a seasoned speaker and nonprofit board member who believes that collaboration has a multiplier effect. She holds a Master of Public Policy from UC Berkeley, and lives in Park City, Utah with her family.

Multiplier Advisors is a national impact investing consultant connecting the healthcare and community development industries. We provide boutique services to SDOH Impact Investors and SDOH Investment Intermediaries, helping them identify SDOH Investable Opportunities and create innovative partnerships that invest in SDOH. Visit www.multiplieradvisors.com.