The story of how Napa created an ADU accelerator system to address its affordable housing shortage and strengthen its social fabric

by Jennifer Palmer

Napa, California, is doing innovative things to support Accessory Dwelling Units (ADU) as an affordable housing solution: building the foundation of an ADU Accelerator System. But it hasn’t happened overnight. It’s a seven-year story of the Napa Invest Health work that started with two separate issues to solve for – a severe affordable housing shortage and a need to build more community cohesion, which turned out to be connected.

Napa’s Invest Health team has been focused on accelerating the development of ADU’s since 2016. Unlike traditional affordable housing unit developments, each ADU produced benefits for two households: one with affordable rent, the other with either valuable income and/or family connection and support (which strengthens social cohesion for the community). This is important because our local data shows an equal number of homeowners struggling with (1) aging-in-place as workforce members struggling to live near where they work; and (2) families needing options to support intergenerational living.

Additionally, development time for ADU’s is around 18-24 months, whereas traditional large affordable housing projects can take 60-72 months (or longer) to bring to market. ADU’s cost about half as much because they leverage existing land and utility infrastructure. Together this means investments in ADU’s can net 2:1 the number of affordable units per dollar invested, benefit twice as many households per unit, and bring units to market in less than half the time of traditional developments.

Unwinding the Financing Puzzle

Initially, our team spent a lot of time and energy focused on financing and trying to solve a seeming chicken-or-egg problem with access to capital: Homeowners looking to build a rental ADU were unable to have the future rental income considered in conventional loan underwriting. We pitched a range of entities on ways to solve this problem throughout most of 2017 – from conventional banks and Community Development Financial Institutions (CDFI’s) to philanthropic organizations to State and Federal lending policy makers. Then the first of what would be several federally declared wildfire disasters struck here, and everything changed – our community, our team and timeline, and our housing needs in Napa. The numbers showed we lost 655 homes in the 2017 Napa Fire Complex, but the real data was in the stories of loss, underinsurance, and the challenges of rebuilding.

Over the years, and following each new disaster (including COVID), new data informed new strategies to meet new conditions and it got easier to move toward action. Local data has consistently reinforced the need to ease homeowners’ path to becoming one-unit affordable housing developers.

Napa has now piloted the three unique components forming the foundation of an ADU Accelerator System:

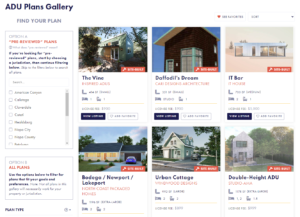

- The Napa Sonoma ADU Center, created in March of 2020, is a “one-stop shop” website designed to move homeowners thinking about building an ADU from intent to action. It provides a host of ADU tools and resources including an ADU Workbook, Calculator tool, webinars, feasibility consults, Plans Gallery (screenshot to the right), and spotlights of Napa County residents who have built ADUs (links to these tools are in a box below).

- An innovative ADU construction loan product from Northern California’s Redwood Credit Union, launched in March 2022, in partnership with the Napa Valley Community Foundation. This unique offering increases access to construction capital for fixed-, middle-, and lower-income homeowners by factoring in future rental income during underwriting, and a better loan-to-value ratio by valuing the completed ADU based on future rent cash flow rather than the cost of construction. Simplifying the loan process lowers the barrier for homeowners who may not have experience with this kind of process.

- Maybe most excitingly, this month we are rolling out the Napa County AADU Forgivable Loan Program. The Napa County Board of Supervisors are making a six-million-dollar investment in forgivable ADU construction loans in exchange for 5-year commitments to rent to households earning up to 80% of Area Median Income. The loans are scaled to the size of the ADU (studio, 1-bedroom, or 2-bedroom), include deferred 3% simple interest, and homeowners can opt out of the program at any time without penalty by paying off the balance. The loan program leverages the extensive technical assistance available through Napa Sonoma ADU Center to support applicants throughout the planning, financing, and building process and provides vital project capital to further improve conventional construction loan underwriting.

Jennifer Palmer is the

Jennifer Palmer is the